The Social Machine

Lewis Mumford | Uncertainty, Risk, and Ambiguity | Factoids | Elsewhere

The most powerful dehumanizing machine is not technology but the social machine, i.e. The formation of command structures to make humans emulate technology in order to build pyramids and skyscrapers.

| Lewis Mumford, The Myth of the Machine

Uncertainty, Risk, and Ambiguity

(Originally posted on the Sunsama blog. Likely to become a chapter in the upcoming booklet on Decision Making.)

Once we harden in our collective thinking, cease to question our core assumptions, and censor those who raise the most hard-to-discuss issues, then we have lost our path through the fog.

Kristalina Georgieva, the Managing Director of the International Monetary Fund, gave a speech in January 2020, only weeks before the covid pandemic spread worldwide, where she said,

if I had to identify a theme at the outset of the new decade, it would be increasing uncertainty.

A few years earlier, I had responded to a call for participation in 2014 by the Pew Research Center for the Digital Life in 2025 report, presaging her thought:

We have already entered the postnormal, where the economics of the late industrial era have turned inside out, where the complexity of interconnected globalism has led to uncertainty of such a degree that it is increasing impossible to find low-risk paths forward, or to even determine if they exist.

The three years of the pandemic, the past year's inflationary spiral, and the recent precipitous collapse of several well-known banks have brought the tied issues of uncertainty and risk into high relief. Those three examples, by themselves, would justify some reconsideration of uncertainty, but it was the rounds of layoffs in the tech sector these past few months that led me to revisit a deceptively complex question: how should we confront uncertainty, both at work, and as individuals?

There are two types of uncertainty: risk and ambiguity. The economist Nicholas Bloom explains this insight from Frank Wrights' 1921 book, Risk, Uncertainty, and Profit:

[Wright] identified risk as occurring when the range of potential outcomes, and the likelihood of each, is well known – for example, a flipped coin has an equal chance of coming up heads or tails. [...] In contrast, what has become known as “Knightian uncertainty” or “ambiguity” arises when the distribution of outcomes is unknown, such as when the question is very broad or when it refers to a rare or novel event. At the outset of the COVID-19 pandemic, for example, there was a tremendous spike in [ambiguity]. Because this was a novel coronavirus, and pandemics are not frequent events, it was very difficult to assess likely impacts or predict the number of deaths with a high degree of confidence.

Bloom points out that we have tools to gauge the level of uncertainty: financial markets act as proxies to measure uncertainty, surveys can be taken to judge the degree of uncertainty in various populations, and semantic analysis of media can ascertain uncertainty via newspapers, social media, TV and radio.

For business, these statistical approaches can be applied to the marketplace, and also to internal questions. For example, to predict next quarter's sales, a company can look to market forces, survey sales managers, or analyze what's being said in company Slack channels. These are ways to quantify the uncertainties of the company's future performance. But the assessments have to be conducted, and the data listened to.

Uncertainty unquantified or unexamined can lead to paralysis. And, when high levels of ambiguity exist, and there is little experience to guide us, companies and governments may respond by reflexively hedging risks -- which is what the tech sector appears to be doing in their massive layoffs allowing them to conserve cash and reallocate funds for some anticipated future -- but often business leaders fail to readjust to the world made foggy by ambiguity.

The deepest risks may not be in the marketplace or what's happening outside the organization -- the rising inflation curve, the competitors adopting new technologies, the new virus emerging in a South Asian bat -- but instead, in the behaviors baked into organizations so deeply that they can't be spoken of.

The failure to hedge increasing risks because of greater levels of uncertainty is exactly what we've witnessed with the collapse of Silicon Valley Bank and Credit Suisse. SVB was caught between long-term investment in U.S. Treasury notes, and rising interest rates, so that the value of their assets had fallen, so when spooked customer came demanding their funds, SVB had to sell assets at a loss, creating a negative doom loop, and the FDIC had to take over the bank.

Even though SVB had been in close communication with the Federal Reserve and FDIC officials, it seems that leadership was unwilling to unwind the risk model at the heart of the bank. At least not quickly enough.

Ginka Toegel and Jean-Louis Barsoux refer to risks that are not spoken of as undiscussables. They tell of an incident at Theranos when an engineer (Aaron Moore) created a prank ad that included "leeches" among the blood testing devices' "blood collection accessories". This led CEO Elizabeth Holmes to launch an investigation into the prank, and he was reprimanded.

The Theranos case illustrates what can happen when questioning voices are silenced and topics placed off-limits. At Theranos, that created a culture of fear and denial that ultimately led to false claims made to investors and customers, as well as decisions that jeopardized patient health. The once-inspiring Theranos story ended with criminal fraud charges filed against Holmes and the collapse of a startup previously valued at $9 billion.

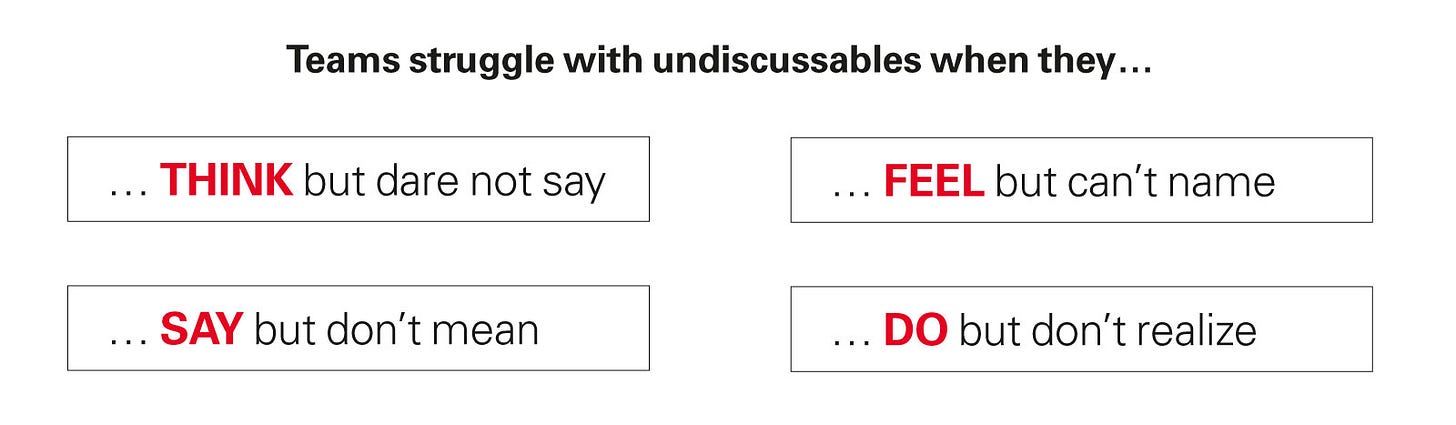

The best response to increasing ambiguity is to reevaluate premises that may be invalidated by various scenarios made more likely by shifting risks. This requires unthreading the various kinds of undiscussables:

You think but dare not say. This self-censorship arises when people fear the consequences of speaking about something openly, which is indicative of erratic management who respond to attempts at frank discussion and criticism with harshness. The fix is to change the culture to eliminate the threat of retribution for speaking openly about the undiscussable.

You say but do not mean. Here we have spoken untruths, the mirror image of truths unspoken. Toegel and Barsoux relate the story of a paper company whose leadership embarked on a 'company reinvention' in response to plunging demand due to the rise of the digital world. However, at retreats and protracted meetings the initiative seemed focused only on cost-cutting and greater efficiencies. It was only after several rounds of downsizing that the CEO realized the hypocrisy of this 'reinvention', and responded by turning the problem of reinvention over to a larger, younger, more diverse group with greater experience outside the paper industry, who eventually developed a successful plan to shift into a renewable materials company.

You feel but cannot name. Negative feelings that may not be expressed openly -- like distrust of a manager by team members -- doesn't stop the feelings from being manifested in non-spoken ways. It may be painful, but the solution is to name the issues and work out some truce, and -- as in warfare or counseling -- this may require neutral third parties to mediate.

You do but do not realize. As the authors state, "The deepest undiscussables are collectively held unconscious behaviors. These undiscussables are the most difficult to uncover." These are often caused by anxiety among a group causing avoidance or defensive routines that reduce anxiety in the short-term, but then in the long-term derails learning new behaviors or attacking the root cause of the anxiety.

Heightened uncertainty, risk, and ambiguity are perhaps, as Georgieva said, the defining theme of our time. The first step with uncertainty is to try to gauge it, and once it is quantified, try to identify scenarios that might occur so that responses can be planned and employed when necessary. But the deepest risks may not be in the marketplace or what's happening outside the organization -- the rising inflation curve, the competitors adopting new technologies, the new virus emerging in a South Asian bat -- but instead, in the behaviors baked into organizations so deeply that they can't be spoken of.

Once we harden in our collective thinking, cease to question our core assumptions, and censor those who raise the most undiscussable issues, then we have lost our path through the fog.

Factoids

Even if you emigrate, can you really get away?

American Citizens Abroad estimates 3.9 million Americans were living abroad permanently as of 2023. According to World Population Review, as of 2024 those millions of Americans were living in 158 different countries. The largest number, about 800,000, were in Mexico.

A number that is likely to rise, at least to some extent.

…

Hummingbirds are astonishing.

Hummingbirds have more power output gram for gram than any other vertebrate.

Engineers and biologists can’t accurately model how hummingbirds fly like they do, and so all efforts to create robotic hummers have failed. They beat their wings about 50 times per second, compared to 9 times a second for a pigeon. They can hover… indefinitely. They can fly upside down. Wow.

…

16% from the 1%.

According to Oxfam International, Jeff Bezos and Elon Musk emit more carbon pollution in 90 minutes than the average human does in their entire life. The report suggests that the wealthiest 1% by income account for 16% of emissions, which is more than the poorest two-thirds of people in the world.

Instead of regulating the carbon exhaust of cows, maybe we should curtail the practices of the 1%.

…

A job that’s not worth a bucket of warm spit.

George H.W. Bush remains the only sitting vice president to succeed their boss since Martin Van Buren in 1836.

But they ran a sitting vice president, anyway.

Elsewhere

Going forward, I am collapsing `Elsewhere` and `Elsewhen` entries, because a different time is also a different place, and in many instances, I can’t figure which is what.

…

Nearest Neighbors | Josh Erb - Reboot

I found the recapitulation of the failed unionization effort at Mapbox by one of the organizers compelling. Note that Erb characterizes the effort as a success, inasmuch as the union was formed; however, the eventual vote — after a great deal of anti-union politicking — led to a rejection of the bid to unionize by the workers at Mapbox. It’s a tale of how anti-union management can pull every string — up to and including firing organizers illegally — to sideline what started as a majority of the workers wanting a union.

“Organizing isn’t reading Das Kapital,” proclaimed labor organizer Emma Kinema in a 2022 interview with Reboot. That is: when faced with poor working conditions, theory alone won’t solve your problems. A union, however, might.

In today’s essay, writer and software engineer Josh Erb tells the first-person story of the Mapbox Union effort: what inspired him to organize, the opposition the union faced, and what he learned about power and solidarity along the way.

— Jasmine Sun, Reboot Editorial Board

…

Alain Supiot: “From the ballot box to work, we are witnessing the secession of ordinary people” | Alain Supiot

One of the most thought-provoking articles I read in 2024: In a long interview in Figaro in July 2022, the French social theorist Alain Supiot discussed many of the themes of his recent book La Justice Au Travail (Justice at Work). Difficult to summarize, however, much of the interview deals with the alienation of 'ordinary people' from the institutions of government and work, although he uses the term 'secession' rather than the Marxist term 'alienation'.