New Realms of Ignorance

Elizabeth Kolbert | The Irony of Energy | The Productivity Spread | Jane Jacobs Still Inspires | Factoids | Elsewhere and Elsewhen

Quote of the Moment

As people invented new tools for new ways of living, they simultaneously created new realms of ignorance.

| Elizabeth Kolbert

This quote sets the context for the next section, which discusses how we are spiking carbon-based energy production in our quest to decrease our dependence on it.

The Irony of Energy

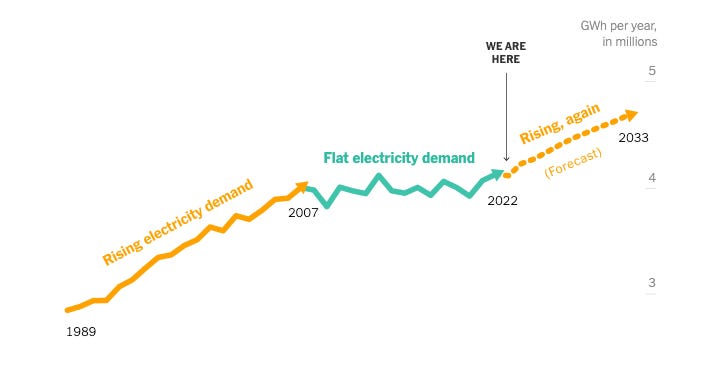

The surge of investment into green technologies and manufacturing in the U.S. is leading to a paradoxical result: our efforts to fight climate change by transitioning to a lower carbon economy have led to a projected spike in energy demand, spewing even more carbon into the environment.

Over the past year, electric utilities have nearly doubled their forecasts of how much additional power they’ll need by 2028 as they confront an unexpected explosion in the number of data centers, an abrupt resurgence in manufacturing driven by new federal laws, and millions of electric vehicles being plugged in.

Many power companies were already struggling to keep the lights on, especially during extreme weather, and say the strain on grids will only increase. Peak demand in the summer is projected to grow by 38,000 megawatts nationwide in the next five years, according to an analysis by the consulting firm Grid Strategies, which is like adding another California to the grid.

What’s causing this at the street level? Brad Plumer and Nadja Popovich continue:

Investment in American manufacturing is hitting a 50-year high, fueled by new federal tax breaks to lift microchip and clean-tech production. Since 2021, companies have announced plans to spend at least $525 billion on factories for semiconductors, batteries, solar panels and more.

In Georgia, where dozens of electric vehicle companies and suppliers are setting up shop, the state’s largest utility now expects 16 times as much growth in electricity demand this decade as it did two years ago.

Millions of Americans are also buying plug-in vehicles and electric heat pumps for their homes, spurred by recent federal incentives. In California, one-fifth of new cars sold are electric, and officials estimate that E.V.s could account for 10 percent of power use during peak hours by 2035.

On top of that, record heat fueled by global warming is spurring people to crank up air-conditioning, causing summer demand in Arizona and Texas to rise faster than forecast.

Many worry the grid won’t keep up.

What is needed is a national push to bring more renewable energy projects online by unsnarling the myriad regulatory barriers that slow rollout. Otherwise, the grid won’t keep up, and the economic boom — and all the well-paying jobs — that all this investment is driving may collapse. Not to mention all the carbon being released.

The Productivity Spread

U.S. productivity is much higher than in the Eurozone and UK. Much higher. Nobody seems to know why, except maybe 1/ Europe hasn’t figured out how to use computing to increase productivity, 2/ U.S. investments -- CHIPS act, etc. -- are leading to an increase in business investments, and 3/ European and U.K. energy costs are holding them back.

From the (paywalled) Financial Times:

The US has widened its productivity lead over Europe, sparking fears in the EU that it faces a “competitiveness crisis” as policymakers call for greater public and private investment.

New data released on Friday showed eurozone productivity fell 1.2 per cent in the fourth quarter from a year earlier, while in the US it rose 2.6 per cent in the same period, separate data showed. Labour productivity growth in the US has been more than double that of the eurozone and UK in the past two decades.

Some economists argue that the US is growing faster than the eurozone in part because its population is younger, growing more rapidly and working longer hours. But a big part of the output gap is because people in the US also produce more for each hour that they work.

I recently cited Joseph Brusuelas and Tuan Nguyen’s research for a Quote of the Moment, but I didn’t detail the insights I pulled it from. Here’s the gist from my notes (text in single quotes are from Brusuelas and Nguyen):

'The increase in American productivity over the past year, if sustained, is a potential game changer for the economy that represents that mythical rising tide that lifts the living standards of all.'

'The 3.2 % increase in productivity during the final quarter of the year and 2.7% on a year-ago basis has most likely been a catalyst for both robust economic growth and disinflation over the past year.'

'Investment spending on structures grew at a torrid pace of 8% in each quarter on average over the past six months, while spending on intellectual property and equipment grew by 5.5% and 2.8% on average, respectively.'

They identify some factors:

'Rising wages: An increase in labor through better pay that attracted disaffected workers back into the labor force.

Full employment: Workers can now acquire better jobs and receive training which increases output per hour.

Manufacturing revival: The CHIPS and Science Act, the bipartisan infrastructure act, and the Inflation Reduction Act have all led to a surge in manufacturing capacity.

Immigration: Legal immigration has helped increase the supply of labor amid a chronic shortage of workers.'

'It is no mystery that during a time of high inflation, high borrowing costs and persistent labor challenges, businesses were forced to become more efficient by making productivity-enhancing investments.'

The researchers don't know what the impact of WFH and AI are.

It seems likely that the difference in productivity between the U.S., Eurozone, and U.K. companies is due to differences in government investments arising from industrial policy differences. The U.K. and Eurozone just aren’t making equivalent investments.

Jane Jacobs Still Inspires

In her seminal book, "The Death and Life of Great American Cities," the late Jane Jacobs posed a rhetorical question: “Does anyone suppose that, in real life, answers to any of the great questions that worry us today are going to come out of homogeneous settlements?”

She might just as well have asked, “Does anyone suppose that path-breaking, awe-inspiring products and services will come out of intellectually homogeneous companies?”

All too often, managers surround themselves with people whose life experiences mirror their own. Over time, the gene pool becomes a stagnant pond. Year after year, it’s the same people having the same conversations about the same issues, often in the same beige conference rooms. That has to change.

| Michele Zanini via Twitter, and he still inspires, too.

Factoids

410% — The percent rise in U.S. layoff announcements year-over-year in February, according to data from Challenger, Gray & Christmas. Last month was reportedly the worst February recorded since 2009 regarding job layoffs.

I guess all those leading layoffs haven’t looked into the research that shows they usually only benefit companies in the short term, because finding people later on to fill new jobs in a boom economy (which is what we are in, let’s face it (see The Productivity Spread, above)) is more costly in the long term than the labors costs of retention. What’s driving it?

The continued cuts come as companies are under pressure from investors to improve their bottom lines. Wall Street’s sell-off of tech stocks in 2022 pushed companies to win back investors by focusing on increasing profits, and firing some of the tens of thousands of workers hired to meet the pandemic boom in consumer tech spending. With many tech companies laying off workers, cutting employees no longer signaled weakness. Now, executives are looking for more places where they can squeeze more work out of fewer people.

| WaPo

It’s the investors doing stupid again.

…

Every 1% increase in legal migrant numbers — and the overwhelming majority of migrants into the west do arrive legally — adds an average 2% to GDP in Western countries, and average unemployment rates have not increased despite all the recent population inflows.

Debunking the ‘immigrants steal jobs from Americans’ bushwa.

…

Here’s an unusual argument for staying on daylight savings time year-round, from biologist Laura Prugh:

Staying on daylight saving time year-round would prevent an estimated 36,550 collisions between deer and vehicles, whereas staying on standard time would add 73,660 of these collisions every year — a difference of more than 100,000. The human toll of staying on standard time would also be significant: Compared to year-round daylight saving time, year-round standard time would cause 100 more deaths, 6,000 more injuries and at least $3.5 billion in costs every year through increased deer-vehicle collisions alone.

Elsewhere and Elsewhen

Keep reading with a 7-day free trial

Subscribe to Work Futures to keep reading this post and get 7 days of free access to the full post archives.