History Teaches

Antonio Gramsci | Upside-Down Story about an Upside-Down Reality | Elsewhere: Speaking of WFH, Vulnerability, The Robot Curve, More Posts

History teaches, but has no pupils.

| Antonio Gramsci

…

Gramsci offers something that slightly clashes with George Santayana's more well-known observation, ‘Those who cannot remember the past are condemned to repeat it’ (or its many paraphrases). Santayana is quite specific about what will happen to those who forget the past. At the same time, Gramsci broadly condemns us to ignorance, asserting we are unable to learn from history at all.

Here and now, in March 2025, I favor Gramsci’s naked pessimism over Santayana’s dressed-up fatalism. At least in Gramsci’s worldview, it’s not a lack of studying the past that dooms us; it’s the nature of the world itself.

An Upside-Down Story about an Upside-Down Reality

Joe Gose, in Signs of an Office Market Bottom: ‘The Worst Is Probably Over’, seems to be trying to convince himself that the huge drop in commercial real estate has come to an end, or is at least beginning to come to an end. Or maybe, as Churchill put it, coming to the end of the beginning. But closely parsing the article, it seems Gose has let his hopefulness write an article that should be read from the bottom to the top.

Gose writes that office building sales jumped nearly 21 percent last year, and leasing activity is up. But later in the article, we learn that many sales are driven by speculators buying up distressed and marked-down properties. The ‘good news’ seems to be limited to 'well-located, high-end properties in major U.S. markets', not everywhere.

Leasing activity appears to be up because companies are taking advantage of realtors willing to up the level of build-outs, in effect lowering the mortgage prices considerably. But this is summarized at the top of the story, a hypothetical reader would have to cut-and-paste the facts into a coherent story to get there.

And, pulled from the bottom third, this fact, which should be the headline: office vacancies

continued to climb last year in plenty of the largest U.S. office markets with vacancy rates of more than 20 percent, including Atlanta, Chicago, San Francisco and Los Angeles.

And then this out-of-the-blue statement, totally unsupported by data:

Companies are looking for more office space as work-from-home policies peter out, office landlords and developers said, with many seeking premium buildings with state-of-the-art amenities.

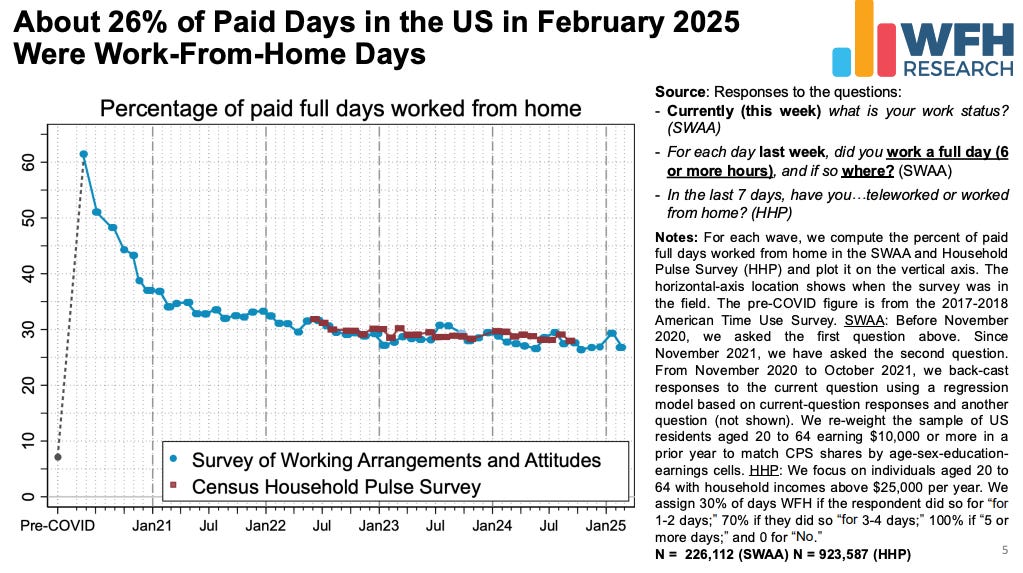

The nice folks at WFH Research have the actual data on working-from-home which shows a fairly consistent line of about 26%:

There is no recent spike in returning to the office, despite all the corporate leaders howling about it.

Gose recounts many discussions with speculators who are buying distressed properties for 25% of their previous sale prices and with on-going leases that exceed that rock-bottom price.

Also buried below the fold is this:

Not all office properties are experiencing revived demand. Lower-end buildings are still struggling, which could be a threat to hundreds of banks and investors in real-estate-backed loans.

The urban doom loop continues for most commercial real estate.

Indeed, prime office assets ended 2024 with an average vacancy rate of 15.3 percent, compared with 19.2 percent for nonprime office properties nationwide, CBRE reported.

And Trump has introduced a new factor:

There’s also the question of how much a potential flood of federal office assets into the market may affect sales and vacancy. Already, Elon Musk’s Department of Government Efficiency has slashed 8.5 million square feet of federal agency leases, cutting rent by more than $318.5 million.

Stepping on the fingers of someone hanging from a ledge.

The article is written upside down. All the hard stats in the final third should be up front, and all the wheedle-deedely wishing on a star should come last, and in the middle Gose should have provided the missing actual stats on WFH numbers, not the lying 'WFH is petering out' denial.

…

I submitted this to the NYTimes comments section:

'The line -- 'Companies are looking for more office space as work-from-home policies peter out' -- is not supported by data from WFH Research (https://wfhresearch.com/wp-content/uploads/2025/03/WFHResearch_updates_March2025.pdf), which shows about 26% of paid days in the US in Feb 2025 were work-from-home days, and a fairly smooth curve for the past year. There is no evidence that WFH is 'petering out'. It's rah-rah boosterism of commercial real estate people.

That comment has been published.

Elsewhere

Speaking of WFH

WPP Will Bring Employees Back to the Office Four Days a Week | Kyle O'Brien: '

Global holding company WPP will require employees to return to the office at least four days a week starting in April. The decision will affect the company’s 100,000-plus employees worldwide.

There is no other news here or useful commentary. Just more group obstinacy.

…

Vulnerability

In Jack Welch's Theory of Leadership: A Model for Failure in the 21st Century, Andrew McAfee explores the role of vulnerability (or invulnerability in the case of Jack Welsh) in leadership. I’m not usually much focused on managers-to-the-exclusion-of-managees, and apex leaders in particular (too much inbreeding leads to a lot of psychopaths at the top of pointy pyramids). Still, McAfee is on to something here: the role of vulnerability in company culture.

…

The Robot Curve

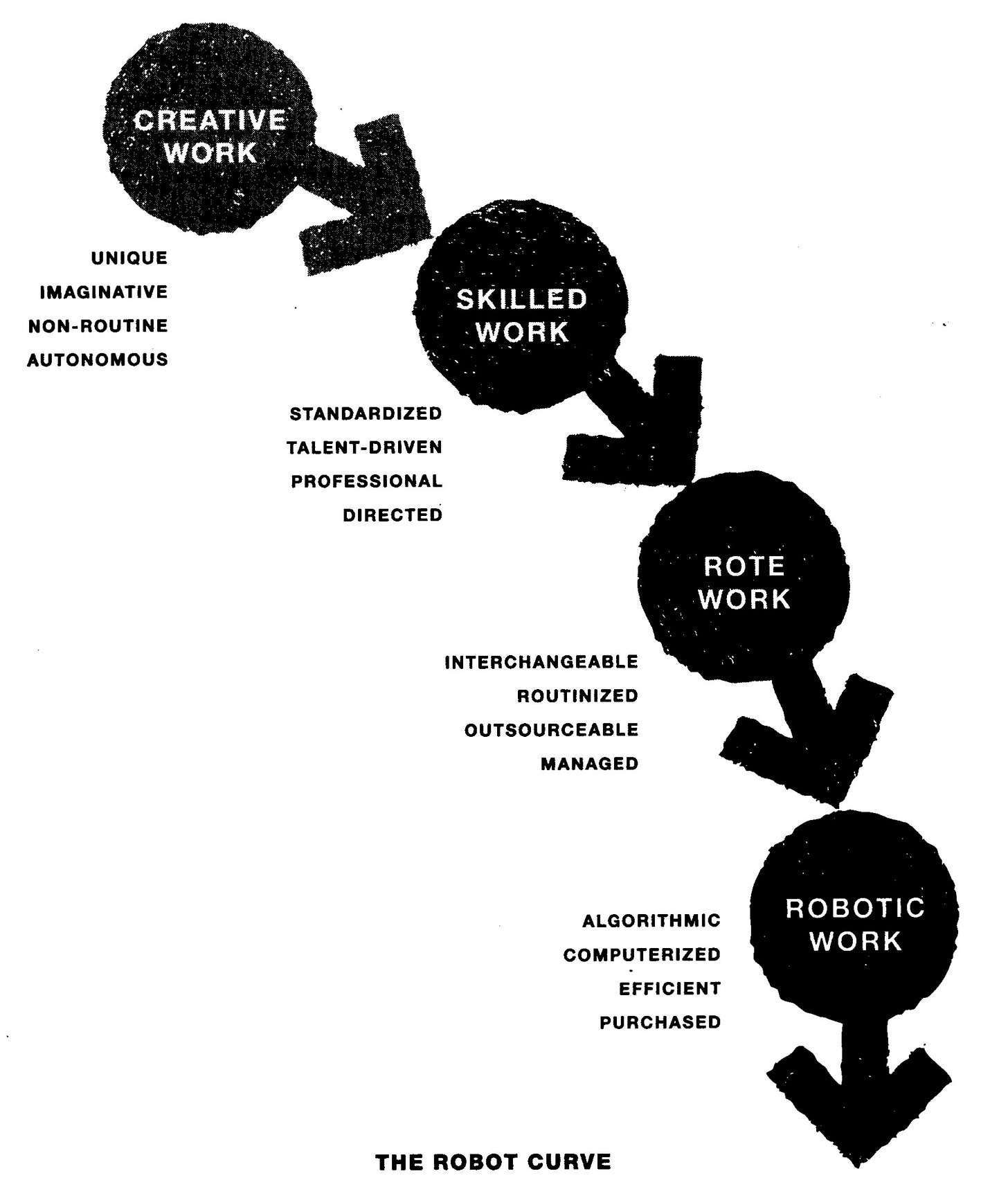

Via Marty Nuemeier:

Here's how the “Robot Curve” lowers both the cost and value of work over time. Creators have to continually fight their way back upstream to produce value.

…

I recently published various posts on my other substacks: